=============================================================================

In Short- Key Points:

>> India is on track to become the world’s third-largest economy within a few years, driven by a huge, young, digital-first consumer base. >> Global supply chain shifts are making India the most credible “China +1” alternative — for sourcing and selling. >> Every major sector — manufacturing, smart infrastructure, consumer goods, digital services — has an India story. >> Many Western brands fail when they underestimate India’s diversity or think their Western playbook will just copy-paste. >> Winning here means understanding the “middle 500 million” — smart pilots, local partners, and a plan built on real ground truths.

=============================================================================

If your business isn’t planning for India now, you’re planning to watch someone else scale instead.

India isn’t “the next big thing” anymore. It is the big thing — right now. By the end of this decade, India will pass Germany and Japan to become the world’s third-largest economy, behind only the U.S. and China. The country’s urban middle class is expected to swell to over 700 million people by 2030 — bigger than the entire populations of the U.S. and EU combined.

Why ‘Now’ Is Different

If you’re a North American SME, the idea of “doing business in India” has probably been on your radar for years — but it always felt too complex, too slow, or too far off. Here’s what’s changed:

• India’s internet users number a little over 900 million. 500 million of those were added in just the last 10 years- that’s more than the US and Canada combined [360 million] and some change.

• India’s digital backbone — United Payments Interface or UPI (imagine Venmo in the US or Interac e-Transfer in Canada, but universal) now processes an average, over 11 billion digital transactions a month. From street vendors to global brands, frictionless payments are the norm.

In May ’25 UPI reached a high of 18.4 billion transactions, worth US $ 293 billion. For comparison, Venmo’s 2024 annual value of transactions was $270 billion and Interac e-Transfer volume for 12 months Oct’23 to Nov 2024 was 1.4 billion transactions.

• New policies and trade zones (like GIFT City) have made setting up easier than ever.

• The “China +1” strategy is real — COVID and geopolitics forced companies to stop relying on China alone for sourcing and manufacturing. India stepped up fast, not just as a factory — but as a consumer market that can buy what it helps make.

Apple didn’t open its first flagship store in India until 2023 — but when it did, it was clear this wasn’t a test. It was a statement: India is no longer optional. Walmart didn’t tiptoe in either — its $16 billion stake in Flipkart showed how much global giants are betting on India’s domestic demand.

A Market for Every Sector

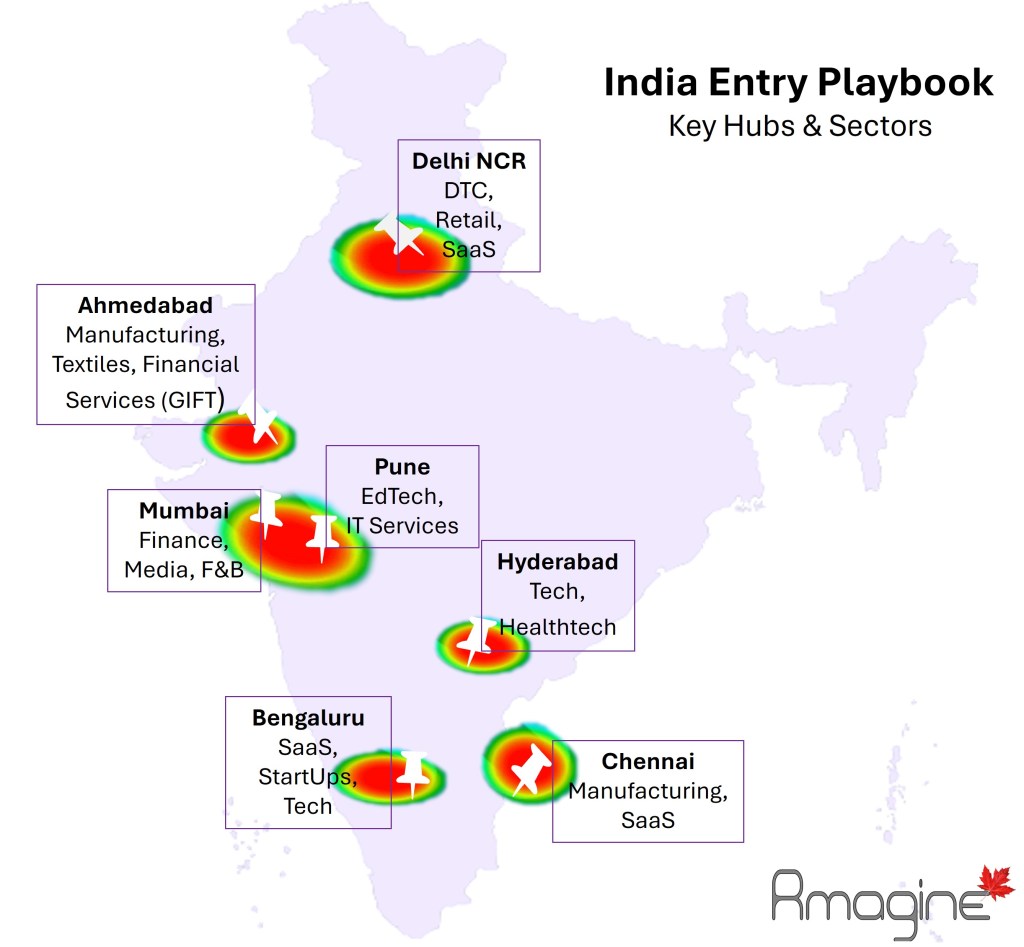

A common myth is that only tech or software companies can thrive here. The reality is broader: Consumer brands from packaged food to lifestyle wearables. Healthcare and smart infrastructure. Manufacturing partnerships for global supply chains. Digital-first services — especially SaaS — targeting India’s huge small business base.

The opportunity is not the top 50 million urban elites in Mumbai or Delhi — it’s the “middle 500 million” spread across Tier 1 and Tier 2 cities, hungry for affordable global quality.

“In India, scale comes from understanding the middle 500 million — not the top 50 million. That’s where your next decade’s growth is hiding.”

–Nandan Nilekani, Cofounder & former Chair, Infosys, India’s Software Unicorn

Where Western Companies Go Wrong

So many Western brands have stumbled here — not because the market didn’t exist, but because they misread it. Target famously shut its India operations after a short, costly run. Others burned capital building one-size-fits-all national launches that ignored India’s regional diversity.

Here’s the reality check:

• India is not one homogenous market. It’s dozens of micro-markets with different languages, cultures, tastes, and price points.

• Pricing matters. A product priced for an upper middle-class New York family can miss the mark in India’s aspirational middle.

• Digital strategy has to bend to India’s digital ecosystem: WhatsApp for commerce, regional social influencers, UPI payments, and now ONDC — an open digital commerce network that flips the script on closed marketplaces.

How to Get It Right — Now

This is where the best businesses & brands get it right:

• Start small, test fast: pilot launches in selected regions instead of a national splash.

• Partner smart: local partners or insights teams [like Rmagine] can unlock distribution, licensing, and the nuances you’ll never spot on Google.

• Go digital-first: mobile-first commerce, local payment rails, WhatsApp channels.

• Adapt fast: treat India as a lab, not a copy-paste.

Western Lens: Don’t just take India’s word for it- global consulting firms have been spelling it out for years. . McKinsey calls India “a core growth engine for resilient supply chains and next-decade revenue”.

The logic is simple: If you’re not planning for India, you’re planning for someone else to take your share.

“India- a core growth engine for resilient supply chains and next-decade revenue”.

McKinsey

Your Next Question

Is your brand or business ready for India’s middle 500 million? Don’t guess- ask.

If you have a key question on your mind, drop your question using the link below. Our commitment? We will answer it. Always. Rmagine will help that kick-off.

[Google Form: https://forms.gle/6KPpbYwmyV7ckdcQ6]

At Rmagine, we help businesses & brands reimagine & think bigger — bridging them internationally into new markets like India, the Middle East, Canada or the US. And boosting the growth of online businesses through bold, data-smart, digital strategy & marketing.